MyTheo Malaysia Roboadvisor Referral Invite Code - ONGCJEBG6Z - RM5 for sign up 2021 - unbiased review with periodic fund performance updates 🏃♂️ ⭐

MyTheo is a new Roboadvisor in town after Stashaway that is currently live already. Users can sign up for this Roboadvisor since May 2019.

Just for more information, there is another Roboadvisior launch after MyTheo which is Wahed invest, an Islamic Roboadvisor, it invests only in ETFs and investment instruments that are permissible by Islam.

You can use my referral/invite code to sign up to Mytheo Roboadvisor - ONGCJEBG6Z. Using my invite code gives you 3 months of management fees waived. Yes, it's not a lot of savings but it's better than nothing. The robo advisor does not seem to have big fundings by venture capitalist firms and I believe that is why their referral rewards is not that attractive.

The management fees charged by myTheo is as follows :

The management fees is slightly higher than Stashaway's fees (0.8%) at the lower tier.

myTheo Roboadvisor is a collaborated company between Silverlake Digital INX and Money Design, a Japanese Fintech firm. Silverlake is a well known company supporting all the big banks in Malaysia. Most of the bank’s backend systems uses Silverlake services. Money Design on the other hand has got experience in Roboadvisor software in Japan. The combined company managing the myTheo Roboadvisor is called Gax MD.

The registration process is similar to most financial apps, you need to go through a series of steps, eKYC (electronic know your customer) to verify your identity. Once registration is done, there will be questionnaire to understand the kind of investor you are, depending on the answers given, myTheo roboadvisor will create a personalized portfolio based on the risk profile of you (based on the questionnaires). The personalized portfolio is grouped into Growth, Income and Inflation Hedge where in Growth there are a list of ETFs that the roboadvisor will recommend. What amount of investment to be put into the 3 groups (Growth, Income and Inflation Hedge) will depend on the risk profile selected.

For unknown reasons (security, I presume), the myTheo application does not allow screenshots to be taken so I had to use another phone to take pictures of the myTheo app. The other 2 roboadvisors like Stashaway and Wahed'ls mobile app can take screenshots.

Personally, I feel Stashaway Roboadvisor’s interface is much better but it is understandable considering MyTheo is considered a newcomer.

MyTheo management fees compared with Stashaway, Wahed Invest and normal unit trust funds

Wahed Invest :

0.8% p.a. fees for RM100 – RM499k

0.4% p.a. fees for RM500k and above

Stashway :

0.8% p.a fees for RM 50K

0.7% p.a fees for RM 50K to RM 100K

MyTheo :

1.% p.a fees for RM 30K

0.9% p.a fees for RM 30k to RM 100K

Mutual Funds/Unit Trusts :

Typically 1.8% for equity funds

On paper, Wahed Invest's management fees could be less than Stashaways. However, I think Stashaway has a slight advantage if you invest above 50K and your management fees reduces to 0.7%. Wahed invest's 0.4% management fees is a bit out of grasp for orginary Malaysians as the total amount invested needs to be 500K which is a very very big amount. MyTheo's fees is on the high side but personally I feel management fees might not be indicator of future performance also.

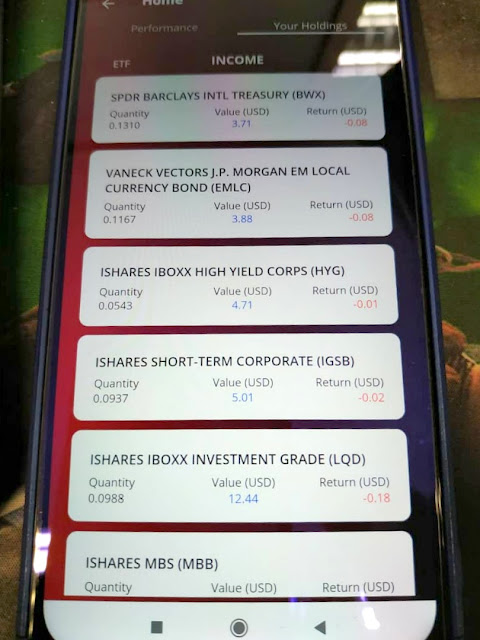

The investment methodology/technique of MyTheo seems quite similar to Stashaways, they are buying US ETFs consisting mostly of iShares and SPDR index ETF.

Links :

Google Playstore Link

Updates : I created 2 portfolio called 1st pot of gold and 2nd pot of gold. 1's portfolio suppose to be conservative while the other will be high risk. So far I've put in RM800 to test and there a very marginal gain of RM1+ but with small net loss due to forex/currency differences. I do expect it to be net gain once Mr Donald Trump pumps up the US equities in search for his 2nd term. A lot of the portfolio are US ETFs so it is natural it will rise based on US policy.

Personally, the interface is not as easy as Stashaway's interface, much harder to navigate around the ui. However, Mytheo's interface is much easier than Stashaway to view the ETFs invested in the portfolio.

Updates 20191128 :

There's some chutes of recovery on my portfolio, I think is because the Dow and Nasdaq are lifting the portfolio up a bit.

Updates 20191219 :

MyTheo CEO Ronnie Tan was on BFM (Business FM) today. Link here

Some key points from the interview :

- Prefers to be called digital investment management than a robo advisor

- Not 100% a black box trading system as there are some inputs required by fund managers

- 0 currency exchange fees

Updates 20191225 :

Christmas update. I've since top up more money into the Roboadvisor. The fund has got some gains but there' still negative currency gains. Hopefully when the Ringgit strengthens my fortunes will reverse.

Updates 20191230 :

Almost year end and MyTheo robo-advisor is in the news already.

https://www.thestar.com.my/business/business-news/2019/12/30/fund-manager-stay-invested-no-matter-what-the-economic-situation-is

Updates 20200109 :

Updates 20200109 :

The portfolio is having some losses mostly due to currency losses making the overall portfolio still in the RED.

Updates 20200121 :

I topped up some cash into the portfolio. Portfolio still negative with losses from currency exchange even though the overall portfolio has got minor asset gains.

I did a quick check and see that the app invests the portfolio into many ETFs which I think could be limiting the total returns. I believe the low returns at the moment is due to over diversification into many ETFs given that each ETF already consists of a basket of stocks. 1 single portfolio consists of ISHARES MSCI Canada, Hong Kong, Japan, Singapore, UK, Frontier, Russell2000, Mid-Cap and Vanguard value.

Updates 20200121 :

I topped up some cash into the portfolio. Portfolio still negative with losses from currency exchange even though the overall portfolio has got minor asset gains.

I did a quick check and see that the app invests the portfolio into many ETFs which I think could be limiting the total returns. I believe the low returns at the moment is due to over diversification into many ETFs given that each ETF already consists of a basket of stocks. 1 single portfolio consists of ISHARES MSCI Canada, Hong Kong, Japan, Singapore, UK, Frontier, Russell2000, Mid-Cap and Vanguard value.

Updates 20200205 :

Portfolio remains quite stagnant at - RM 0.98 cents. Micro losses as the currency losses is almost same as capital gains.

Some news that MyTheo has been highlighted by Fintech Malaysia site to be in the top 20 Malaysian fintech firms.

Updates 20200220 :

Surprisingly the portfolio has swung back to green again. I believe this is because the Ringgit is strengthening against the US dollar as all the ETFs in MyTheo are all dominated in dollars. Hopefully this can be maintained.

Updates 20200411 :

My portfolio was hit badly during the Covid 19 crisis and is down -6.87%. I have not adjusted my risk profile and intend to maintain the existing portfolio composition. Losses at the moment are quite manageable and hopefully the world economy won't go into a tailspin.

MyTheo also announce that they will waive management fee charges for 3 months effective from 1st April. Link to this announcement is here. The management fees will be shown as cash rebates in the system.

Updates 20200520 :

I have topped up my portfolio in Mytheo a bit during the corona virus lockdown period in Malaysia but so far averaging down is not helping. I anticipate that the world markets should recover a bit after countries have lifted their lock down measures. Without the currency gains, my portfolio in MyTheo would be deeper in the red. The fund is only gaining via currency impact (USD rising) while the absolute value has dropped. Right now my strategy for MyTheo is to stay calm, no putting in more investments as their investments are too diversified, I am not able to gauge its future direction, to wait until the covid19 storm is over (~6 months at least).

Updates 20200725 :

MyTheo now is organizing lucky draw with cash prizes for signing up and also investing a minimum of RM300. My investment portfolio in MyTheo has so far recovered to positive territory but albeit having a very small gain. I still reiterate the problem with this app is that it invests in too many ETFs and diversified across to many markets and industries. The currency impact on the funds are also very big and most of the time it causes a loss because of the strength of the USD and the weakness of MYR.

I listened to MyTheo's Facebook Live recently and understood that the majority of their clientele are in their 20s and 1st time investors. Personally, if the performance of MyTheo continues like this, it will have a dent on investor's confidence.

The CTO of MyTheo mentioned that the future of Robo advisor would be on customization to customized the robo advisor to an individual personality, risk tolerance. I do not at all agree with this statement as having too much customization will increase complexity in investing as what is seen now with overdiversification. Robo advisors are suppose to be simple and personally I focusing on reducing volatility and making an above average returns as good as mutual funds should be what Robo advisors strive for.

Updates 20200829 :

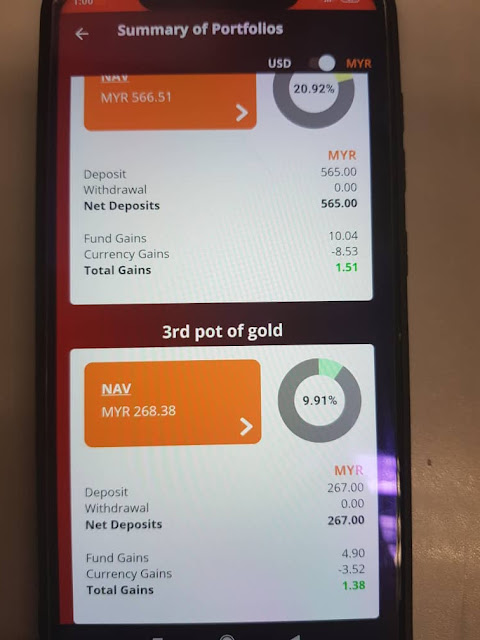

While I've since topped up some of my savings into the robo advisor MyTheo, returns are heavily influenced by currency impact. While my fund is up RM400, there is almost a 50% currency/forex impact on my portfolio.

Updates 20201020 :

Some updates on my portfolio on Mytheo since I've yet to update it for a very long time already. The portfolio still has got huge currency impact which has muted my portfolio gains. This forex risk is especially evident in Mytheo robo advisor since it started as the portfolio does not have Malaysia equities and is very heavily denominated in foreign currencies. The portfolio is also way too diversified that it is quite hard to make money and lose huge sums of money.

Updates 20201118 :

I checked my portfolio again and was pleasantly surprised the fund gains were doubled in line with global markets increase. Of course as usual a big portion of my gains were still muted by forex (currency impact).

Updates 20201227 :

Almost the end of 2020 already, while my MyTheo portfolio is in the green/black, there is still a large amount money lost to "Currency Impact", over 60% of my profits 😲. Moving forward I am not topping up anymore until some major critical global event crashes the market a bit.

Updates 20210501 :

It's year 2021 already, time flies. The currency impact on my investments have reduced a bit. Some of the funds giving out quite good performance and hence there's some improvements in my returns.

⭐Updates 20210512 :

MyTheo's previous referral system (customer get customer) was free 3 months of management fees waived. Now, MyTheo is changing to cash referrals, each sign up referral and referrer gets RM5.

My gains have corrected a bit since the last update. I topped up additional RM100 in the month of May 2021.

MyTheo's portfolio mix is very wide and spreads out from equities, bonds, REITS and metals cross multiple countries also. There's good and bad for such a wide diversification strategy, on one hand it limits downside risk but also upside gains. However, in times of bull markets, it should go up.

⭐Updates 20210904 :

In line with global market recovery and also surge in stock markets worldwide (excluding Malaysia and China), the portfolio is having good positive returns.

Updates 20211019

MyTheo now is investing green. They have launched ESG (Environmental, Social and Governance) portfolio. I've yet to use it yet.

👍MyTheo Referral Invite Code - get RM5 bonus

Here's the sign up link to MyTheo using my referral code/invite code.

Disclaimer : I just signed up only and put in less than 1k into the account. I will be writing a series of blog on this new financial service as time progresses. If you feel this article have given some insight into MyTheo and wish to sign up, do use my invitation link or invite code here or referral link.

In my opinion, robo advisors are not get rich quick systems. They can compliment your existing investment vehicles (unit trusts, ASB, REITS) and are designed for 'invest and forget' kind of investment style. You should not monitor the portfolio daily as it is designed to be automated, to buy and sell ETFs and balance it based on your investment appetite. I also like to think robo advisors as a virtual coin containers (sometimes dubbed as a piggy bank) where all your spare change are put inside it and it accumulates over time where in this case you transfer all your space change (cash) online to robo advisors. This way of moving spare change is called micro-savings and micro-investing was previously not possible using unit trusts due to minimum initial investment (eg min RM1000) and subsequent investment (eg min RM100).

💰 Robo advisor management fees reference :

Wahed Invest :

0.8% p.a. fees for RM100 – RM499K

0.4% p.a. fees for RM500K and above

Stashway :

0.8% p.a fees for RM 50K

0.7% p.a fees for RM 50K to RM 100K

👉MyTheo :

1.% p.a fees for RM 30K

0.9% p.a fees for RM 30k to RM 100K

Raiz Invest *note - behind is buying PNB unit trusts

0.0.25% p.a above RM 6K

Akru (2020 Made in Malaysia robo advisor)

0.7% fess for RM100K

FSMOne Managed Portfolio :

1% p.a fees

1.25% sales fees

Due to time constrain, I did a very short video showcasing the interface of MyTheo mobile app.

Watch this video below on the interview with MyTheo CEO Ronnie Tan to understand more about MyTheo.