BIMB Investment, a sister company of BIMB (Bank Islam Malaysia) Bank has launched a new robo advisor robo intelligent app called BEST. I believe this is the 1st unit trust fund company to come out with their robo advisor robo intelligent app

So far all the existing robo advisor players are not local unit trust fund companies (eg Stashway, Wahed Invest and MyTheo). At the moment also, there are another 2 more robo advisor players which have got operation licenses but have yet to launch their robo advisor product in Malaysia, they are Raiz Invest and Robowealth (Odini app).

One of the most prominent difference between other robo advisors and BEST is BIMB's robo advisor BEST allows an initial investment of just RM10. This provides a very low level entry point for investors. Their most likely target customers are the millennial generation. The second differentiation is that the funds that the robo advisor invests in are all shariah compliant funds, making this the 2nd robo advisor after Wahed Invest to offer such facilities to our muslim compatriots. Non muslims also can use the app and invest in its funds, it will be offer another alternative investment vehicle to their existing investment portfolio.

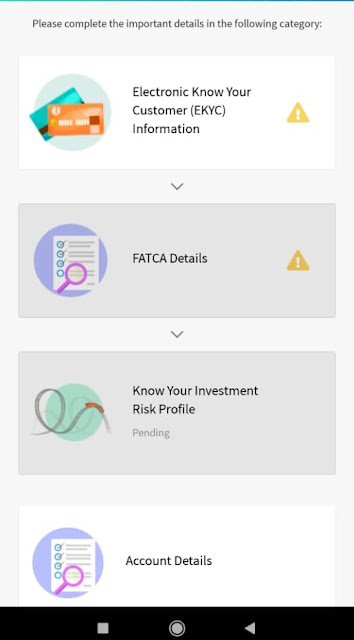

Registration is done full online via the app and you have to take a selfie and a picture of your identity card during the registration process. Registration approval took around 2 working days.

So far all the existing robo advisor players are not local unit trust fund companies (eg Stashway, Wahed Invest and MyTheo). At the moment also, there are another 2 more robo advisor players which have got operation licenses but have yet to launch their robo advisor product in Malaysia, they are Raiz Invest and Robowealth (Odini app).

One of the most prominent difference between other robo advisors and BEST is BIMB's robo advisor BEST allows an initial investment of just RM10. This provides a very low level entry point for investors. Their most likely target customers are the millennial generation. The second differentiation is that the funds that the robo advisor invests in are all shariah compliant funds, making this the 2nd robo advisor after Wahed Invest to offer such facilities to our muslim compatriots. Non muslims also can use the app and invest in its funds, it will be offer another alternative investment vehicle to their existing investment portfolio.

Registration is done full online via the app and you have to take a selfie and a picture of your identity card during the registration process. Registration approval took around 2 working days.

In terms of fees, there is no sales charges applied but the funds charges management fees similar to existing management fees of unit trust funds. Do note that the management fees is also higher than existing management fees charged by the other robo advisor players (eg Stashway, Wahed Invest and MyTheo).

Just like all robo advisors, upon registration you will need to answer a list of questions to find out your risk appetite and the relevant weight age and fund investments to give.

Once registration is completed, very similar to all robo advisors, you can create a savings goal. There are the standard general goals and custom goals which you can select in the app.

The robo advisor currently can invest into 5 funds with varying risk/reward levels that are tied back to BIMB Invest's unit trusts/mutual funds. The types of funds that BIMB Invest has are global equities, Asia Pacific equities, Malaysia equities, Sukuk and money market funds. The funds are shariah-compliant investments that seek to positively impact the environment, society, and governance (ESG) of businesses. Basically the investments in the funds are filtered to ensure the entities that is invested are sustainable. One thing I noticed missing was there were no gold/silver funds for the BEST robo advisor and invest in.

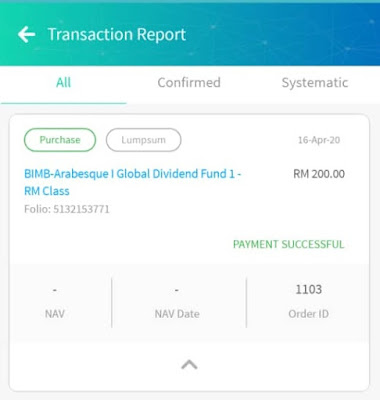

I am still researching and analyzing this app and have downloaded it and have deposit in money into their Global Dividend fund called the BIMB Arabesque I Global Dividend Fund. From what I checked, this fund invests in artificial intelligence (AI) and big data technology companies. I've started putting in RM 200 as starting capital. You can choose lump sum or weekly/monthly contribution. Payment at the moment is only via FPX payments. I hope the company follows Opus Investment style by also allowing payments via ewallets like Boostpay/TouchNGo.

The performance of this fund has been down around 9% year to date but I figure there is nothing to lose as I should be entering at a low price point because of the covid19 situation right now.

The interface of the app is beautiful and easy to use. The only complain I have on the interface is the text is a bit small for my eyes. I also like it that they brand it with the word BEST making it from a SEO (search engine optimization) perspective sound like it is the best robo advisor around town.

Overall this BEST app is a good step forward for BIMB invest and I expect other unit trust companies to also follow suite to come out with such an app. Moving forward for the unit trust/mutual fund industry, sales charges are being removed as during last few years, a large portion of sales charges were allocated for the commissions of unit trust agents. The moment an investor puts in money into the unit trust/mutual fund, they already lost money to the sales charges.

Robo advisors are best used as digital cashbox (tabung simpanan digital) to save your loose change, grow it and hopefully reach your saving goals. One cannot make significant savings by just invest RM10, these robo advisors products need to serve as a complimentary investing vehicle to your existing investments. My blog post on the other robo advisor in Malaysia Wahed Invest is here.

As the BEST robo intelligent platform allows only RM10 as investment additional and initial investment, the strategy to approach this is to do a micro savings method which is to put whatever RM10, RM20 you have left in your bank account into BEST and also if money permits, you can do RM10-RM50 kind of regular investment into your BEST account. This ensures you savings are maximized instead of just sitting there lying in your bank savings account. As the malay sayings go "sedikit sedikit lama lama jadi bukit" , your micro savings will eventually pay out in the long run, maybe it won't buy you a luxury car but it can be a backup savings plan to complement your existing retirement investments.

Update 20200421

My global portfolio has made some tiny gains so far, at around RM 0.94.

Update 20200422

Today I tested 2 features, buying RM10 worth of their money market fund called BIMB Dana Al Faktim and it went through. At the same time I also bought RM200 of their Sukuk fund called BIMB ESG Sukuk Fund Class A. I particularly like the add to cart feature where I can just select the funds I want to invest in and put all into a "shopping" cart and pay the total amount later upon confirmation.

Update 20200423

Portfolio update today with some very slight increase. I hope the upwards momentum can continue.

Update 20200427

BIMB's communications team person reached out to me and clarified with me that their platform is not a robo advisor but they are referring it as a robo intelligent platform. One of the reasons is the robo advisory is a framework from securities commissions (SC) while BIMB is a unit trust company holding a Capital Markets Services License (CSML) and it was explained that it therefore cannot be classified as a robo advisor platform.

Update 20200428

Portfolio now. I'm topping up more when the world markets are in turmoil due to the corona virus situation. I think there' a good chance of reversal in the world markets once all the lockdown measures are lifted.

Update 20200520

ok I spoke a bit too soon, the portfolio turning RED now.

Links

#bankislam