Funding Societies peer to peer lending p2p and financing referral code - j6a79nam and my investment strategy

Funding Societies has been around for some time as a peer to peer lending platform. Peer to peer lending is basically a kind of crowdsourcing where everyone pools in money and lends to a certain business.

Peer to peer lending (aka p2p lending) in Malaysia is currently a legal business venture but requires approval from Securities Commission Malaysia. The industry is also being regulated tightly by Securities Commission Malaysia. More information on peer to peer lending by Securities Commission can be obtained here. Funding Societies in one of the peer to peer lending companies with a license to operate in Malaysia.

Business or sole proprietors tend to use p2p funding for the following reasons:

1. Fast approval and disbursement of loans

2. Not as stringent as banks

Why is current peer to peer lending apps appeals to investors :

1. Potentially getting higher than average returns

2. Can start with small amount (~RM100)

3. Just few clicks of button on app to participate

A couple of tips I have learnt over the years testing p2p lending :

1. Invest small amounts in each notes ~RM100-RM200.

2. Do not expose yourself to a single issuer.

3. Do not participate in lending with money you need.

4. No need to over analyze the notes quality.

5. Do not use the auto bot (auto investing feature)

An example of a loan is shown below, each borrower's loan request will be identified as a note. The note is basically an offer to lenders/investors to participate to crowdfund/raise money for the borrower. The note will show the amount request (Goal), interest rate (Per annum) and number of days of borrowing. The app also allows lenders/investors to view the credit rating of the borrower. While the credit rating of the borrower is given, the name of the borrower will not be shown.

Funding Societies's notes are graded base on CTOS's SME Rating.

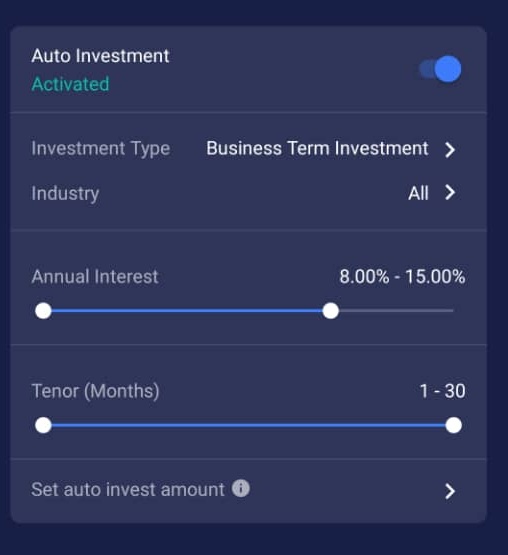

The Funding Societies app comes with some automation features where they call it an “investing bot”. The option is under “Auto Investment”.

You can use this bot to automate investing in the notes(borrower’s loan). Personally I do not use the bot much and prefer to manually do it myself. However the bot has many features like

1) Control risk by reducing exposure to a certain borrower

2) Exclude certain industries (if you find the industry risky).

3) Amount of each investment into each note (minimum and maximum amount).

4) Type of investment (Accounts Payable Financing, Business Term Financing and Accounts Receivable Financing)

Once you have setup the parameters of the bot and have sufficient cash in the app, the bot will execute and invest in notes which matches the parameters to set.

Peer to peer lending in Malaysia is still at its infancy stage and is a growing alternative platform for investing your money for higher than FD returns. In countries like US, P2P financing can even be used for personal loans like doing house renovation or other personal usage. It is a good thing that P2P financing as personal loans is not allowed in Malaysia as this type of financing is even more higher risk than business financing.

Peer to peer lending to me wasn't exactly smooth sailing either. I did have my share of defaults (borrowers not able to payback the loans). I currently have a total of 10 loans which are in Default mode with a potential write off of RM 675.43 and Funding Societies has initiated negotiations and litigation steps to recover monies from the loan.

I've tested another popular P2P financing platform called Fundaztic, personally I find Funding Societies's notes to be higher in quality as the people that are borrowing are from SMEs while quite a large number of Fundaztic's borrows are sole proprietors or 2 man business entities. While I don't have proper statistics, my Fundaztic account seems to have more defaults than Funding Societies for the same amount invested.

Funding Societies Referral

http://promo.fundingsocieties.com.my/referral-program/?r=j6a79nam

⚠️Disclaimer : I usually only put up disclaimers when the investment is considered high risks. P2P investments are considered quite high risks, probably even higher risk than stock market as you are not able to exit after subscribing to a loan. Some of the companies seeking p2p loans banks won’t even dare to lend as they have weak credit scores, and hence the risk in participating in p2p loans. Whilst the P2P lending industry in Malaysia is regulated by Securities Commission, it does not mean you will not lose money from participating in P2P lending.

🔗Links

https://fundingsocieties.com.my/

https://propfessor.blogspot.com/2021/05/my-funding-societies-peer-to-peer.html