For a very long time, Australian robo advisor Raiz Invest which already got a robo advisor operating license from securities commission was suppose to launch earlier this year in Malaysia did not see much activity. Finally after the long wait, the robo advisor Raiz Invest finally launched on 1/7/2020. Raiz Invest Malaysia has a collaboration with Malaysia’s PNB (Permodalan Nasional Berhad) and PNB is the company behind Amanah Saham unit trusts/mutual funds.

Like all other robo advisor apps, registration was quite straightforward, just upload of identity card is required. The entire onboarding (registration) and KYC (know your customer) are done fully online, there is no need to visit any physical branch.

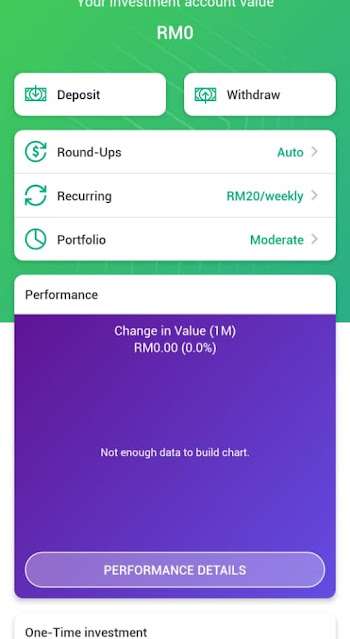

A slight difference between Raiz Invest robo advisors is you need to tie your Bank debit card to the app and all top ups will be done via the bank's debit card, no FPX or bank transfer is used. Currently only Maybank debit card is supported. This tie up with your Bank (Maybank) debit card is referred to as your spending account. The tie up of the debit card to the Raiz Invest app has 3 functions namely :

- tracking your spending (will be categorized)

- rounding up your spendings (taking a micro part of it for investing)

- top up your investments (lump sum or periodic/recurring debit) - from as low as RM5 only

I can safely say Raiz Invest robo advisor has the fastest and easiest way/system to top up funds. No need to do FPX/IBG (inter bank transfer) where you have to be transferred to your online bank site and then you have to key in your bank user id, password and then wait for a TAC/PAC/OTP number to arrive. Within the app predefined topup amount buttons are also there to make the keying number process faster.

Just a few clicks in the Raiz Invest app and you can topup your investments, this is because the Raiz Invest app is already tied/linked to your Maybank bank debit card (ATM card). Tops ups are directly credited from your Maybank account.

Generally most robo advisors invests in ETFs (Exchange Traded Funds). However the funds invested by Raiz Invest are limited to PNB’s variable rate/price funds. PNB variable rate funds are basically just unit trusts/mutual funds that are managed by PNB. Variable rate funds are funds where the value (NAV net asset value) fluctuates based on the value of the stocks/investment component in the funds. PNB has the more popular fixed rate funds like Amanah Saham Bumiputera, Amanah Saham Wawasan 2 where the value of the funds will not fluctuate, these funds typically are in high demand and very popular.

Selecting conservative, moderate or aggressive investing settings in the app will adjust the rob advisor's allocation to PNB's variable rate funds. This collaboration between Raiz Invest and PNB is good as Raiz Invest can help PNB to sell their variable rate funds which are less known and less popular among the Malaysian public.

In conservative settings, your money will be spread between ASN Equity 3 Fund (20%) and ASN Sara 1 Fund (80%). ASN Sara 1 funds are mainly in Bank and Company Sukuk (Islamic Bonds).

In moderate settings, your money will be put in ASN Imbang 2 Fund only. The ASN Imbang 2 Fund is already a balanced fund by itself already, that is why ASN Equity 3 and ASN Sara 1 were not in this portfolio.

The fund invests in popular blue chip counters like TNB, Maybank, KLCC REIT and DIGI.

In aggressive settings, your money will also be spread between ASN Equity 3 Fund (80%) and ASN Sara 1 Fund (20%) like conservative settings but the ratio of distribution will be different with more weightage given to invest in ASN Equity 3.

At the moment, users can only choose 1 type of risk out of (conservative, moderate and aggressive). I know some robo advisors allows creation of different risk profiles but at the moment Raiz Invest's system is not so sophisticated yet.

My personal opinion is a savings system should be focused on safety rather than risk. Hence, I will only recommend using moderate and conservative settings.

The management fees charged by Raiz Invest are as follow :

Below RM6,000 = RM1.50 per month

Above RM6,000 = 0.3% per annum (~RM1.50 per month also)

A comparison between management fees of all robo advisors in Malaysia :

Wahed Invest :

0.8% p.a. fees for RM100 – RM499K

0.4% p.a. fees for RM500K and above

Stashway :

0.8% p.a fees for RM 50K

0.7% p.a fees for RM 50K to RM 100K

MyTheo :

1.% p.a fees for RM 30K

0.9% p.a fees for RM 30k to RM 100K

👉Raiz Invest *note - behind is buying PNB unit trusts

0.0.25% p.a above RM 6K

Akru (2020 Made in Malaysia robo advisor)

0.7% fess for RM100K

FSMOne Managed Portfolio :

1% p.a fees

1.25% sales fees

Overall initially, I was not super impressed with the app it only has got PNB funds which only invests in the Malaysia market. This means you are only expose to Malaysia equities. You can easily replicate your Raiz Invest portfolio by buying direct into PNB's variable rate funds via their

MyASB portal.

However, do note that the difference between doing it yourself to buy the funds via PNB's portal is you can just invest with minimum of RM5 using Raiz Invest app while PNB's portal requires a minimum of RM150 for each investments, investment entry point is high and also you need to do the whole FPX transfer to bank's (eg Maybank2u, Pbebank) website to do transfer. Buying via PNB's portal also incurs a sales charge ~2%.

Below shows the sales charges if one were got buy ASN's unit trusts via their portal, there is a sales charge being charged.

The Australian version of Raiz Invest however, has more options and invests in global ETFs and even cryptocurrency funds (Raiz Sapphire portfolio). I hope Raiz Invest would introduce more creative portfolio into the Malaysia version of the app.

The UI (user interface) of the app however was intuitive and easy to navigate.

I have registered an account under Raiz Invest and have deposited RM300 into the account and the risk profile I selected was moderate risk. I also enable RM20 weekly recurring investment into this account. I will provide updates on this investment occasionally when required. I'm not sure how the round up work in real world scenario in Malaysia but I am guessing the rounding up it is done when you spend with your debit card (Maybank). It is most likely whatever I purchase with my debit card will be rounded up and the rounded up values will be accumulated 1st. Once the rounded up values accumulates to RM10, it will be re-invested into PNB funds.

There's an expense tracker in the app but I've yet to test it out yet.

Raiz Invest robo advisor is available on Google Playstore and Apple Appstore here :

📱Raiz Invest Contact (No whatsapp number)

03 2714 6114

❓Why use Raiz Invest?

You use Raiz Invest for the following reasons :

1) You don't have a habit of saving money - Raiz Invest will round up purchases and also have direct debit to automatically save money for you

2) You believe in the strength and potential in the Malaysian Stock Market (KLCI now only a 1500 points)

Having said that, if possible PNB fixed rate/price funds like Amanah Saham Bumiputra and Amanah Saham Wawasan 2020 are still a better bet with less risk. However, do note that PNB's fixed rate funds are very in demand and are all fully subscribed, you can only buy fixed rate funds when other people happen to sell their units.

Updates 20200603

My investments via the Raiz Invest app has been accepted and there's a slight increase due to beginner's luck and I presume this is due to Malaysia equities market making a comeback.

Updates 20200703

I happen to randomly check the rounding up feature on the Raiz Invest app and found that even for top ups, some money is being allocated (RM1) and put into the rounding up funds. Once the fund reaches RM5, I presume it will be invested in the PNB funds.

Updates 20200712

Topped up more into Raiz Invest as it's a cheaper options and putting into ASB direct. Fees per annum only 0.3% compared to buying from MyASB at 1% per annum. There's some slight returns seen from my initial investments.

I also realized using debit card to top up through the app is much faster. When you compare the top up process with other robo advisors. Debit Card top ups do not require TAC/PAC confirmation, it is just a direct debit process from your bank's account.

Updates 20200724

Continuing buying spree a bit with some of my cash reserves. Hope the economy is going into a V-shaped recovery after MCO (movement control order) despite all the bad news around about jobs.

Updates 20200728

Averaging down starting to lose steam. Malaysian stock market is in consolidation mode already. Will stop putting in money for now.

Updates 20200723

PNB did a media launch of Raiz today. I didn't know that Raiz Invest was still in soft launch mode.

After using the app for the past few weeks, I'm finding the app is very convenient to put in spare cash in my account to work. It only takes 1-2 buttons to move money from my Maybank account into the app which is considered very fast compared to other Robo advisors and Unit Trust app which requires going through the whole bank FPX transfer process.

I just got to know that the minimum investment into Raiz Invest can go as low as 5 cents (RM0.05). I've yet to see apps that can do that, I guess this is what they call micro savings.

Updates 20200727

Tried to top up more into Raiz Invest but Maybank sent SMS saying "You have exceeded your daily purchase limit". The error is because the Maybank debit card has got a maximum spending limit per day, need to adjust the spending limit and the transaction will be able to go through again.

Updates 20200729

Somehow I did some calculations, management fees is most affordable at 0.5% for investments above RM6,000 so is better to have my account loaded until RM6,000. The past 2 months of my savings all are moving into Raiz Invest at the moment.

Updates 20200804

Grab the ride sharing company in South East Asia previously bought over robo advisor Bento in Singapore is now transforming the robo advisor into Grab Invest and using the same business model as Raiz Invest via micro saving and micro investing based on your spending. Grab Invest could have an advantage here as it does not require Maybank debit card to do "Round Ups". The "Round Ups" will likely be done via the Grab ewallet.

Updates 20200820

After months of diligently putting my savings into Raiz, I've finally made it above the RM 6K mark, my management fees now will now be 0.3% per annum (also around RM1.50 per month). Previously my investments were below RM 6K and I was paying high percentage of management fees as compared to the amount invested.

My returns are around ~RM200 for such a big amount I've invested but understandable as I'm on the balance portfolio which invests in the ASN Imbang 2 Fund. I think those users who use aggressive portfolio might have better returns in the recent run up in the Malaysian stock market.

I've compiled a table listing the % percentage of management fees you would be paying if you invested below RM6,000. Under RM6K, your management fee is RM1.50 per month which turns out to be RM18 per year already. You will notice you are paying higher management fees at investments less than RM6,000.

While Raiz allows you to just put in RM10 , such low amounts is highly not advisable as initial investments as the RM1.50 per month management fees will end up eating up your capital. At RM10, your management fees incurred is a whopping 180% per annum. If you have lower amount of capital to invest, you can opt to go for other Robo advisors like Stashaway or Wahed Invest 1st whereby their management fees are not so high at small amounts.

Do not put in below RM1,000 as the management fees will be very high and erode your principle (amount of money invested). Just by only starting with RM100, the % of your management fee is a whopping 18%)

Updates 20200909

New updates to the Raiz Invest app to track referrals. The referrals information can be seen at the "Past" investments tab.

On another note, Malaysia stock market is heading below 1,500 points and it could signal buying opportunity as Raiz Invest is invested in Malaysia stock market via PNB's variable price funds.

Raiz Invest Malaysia also has been ramping up their digital marketing efforts via YouTube paid ads. These ads shows up when you view financial related channels or Malaysian channels. I'm wondering about its effectiveness compared to doing friend referrals where the customer acquisition cost is only RM10 (RM5 for referrer, RM5 for 1st time user).

Updates 20200922

Raiz just published the returns of ASN funds under their system. Seems like equities funds (ASN Equity 3) having a bad year with negative returns.

As I had some free time I just browse and see what was the price of Raiz Invest's stock price in ASX (Australia Stock Exchange). The price of the stock is quite stable without too big fluctuations and it is still trading sideways since listing.

Updates 20200923

I took a peek at how Raiz Invest Indonesia was doing and found the business model that Raiz Invest uses in Indonesia is the same as in Malaysia. Indonesian Raiz Invest users also use the Raiz App to buy variable rate/price funds/mutual funds from mutual fund company Bareksa. Similar to Malaysia, the risk level of the investor will determine which

Bareksa funds to invest. Their funds are also similarly simplified as Malaysia with Aggressive, Conservative and Moderate portfolio funds.

📍Links

Updates 20200928

I just found out how to download account statements in Raiz Invest Malaysia App. The location for the screen is not easy to find.

I wrote a blog post here on how to access the account statements screen from the Raiz Invest app

here :

Updates 20201120

Some UI (user interface) updates to Raiz Invest dashboard performance graph.

green line represents ‘invested by you’ which is all your deposits minus any withdrawals, giving you clearer a picture of how much you have saved since opening your account.

white line represents your total balance. The difference between the white line and the green line represents any market gains/losses you have made at that time.

So..as long as the green line is higher than the white line then you are making money/profit out of this investment.

😉 How I'm using Raiz Invest - updated on 20201031

After some thought I have decided to pen and share how I’m actually Raiz Invest robo advisor app. Given that there are so many other robo advisors in Malaysia’s investing landscape (eg Stashaway, MyTheo, Wahed, Akru), it's very confusing to the average investor where to put/invest their money.

I mentioned before that Raiz Invest offers the fastest and most automatic method for investing. The app ties directly to your Maybank account to move funds and also to do automatic savings via round ups. No need to key your banking credentials (id and passwords) for any of these activities and hence its speed and ease execution. You only need to login to the Raiz App and faster logins is possible if fingerprint authentication is enabled.

As I’m treating Raiz Invest as my personal coin box (aka piggy bank), whenever I have some cash from Maybank from some incoming activities I will immediately move it into my Raiz Invest account. Since I treating this as a personal coin box, my Raiz Invest is set to moderate risk as I want to preserve my capital as much as possible while as the same time not be too conservative considering the extreme low interest rate environment we are in now. These incoming activities could be rentals receives, sales from online marketplaces (Carousell, Lelong, Mudah etc), so whenever cash I have even at RM5- RM10 only in my Maybank account I will still move it into Raiz Invest. This serves as a 2nd purpose to help me control my spending because my cash is locked into Raiz Invest and not in my savings account where I might be tempted to spend it. All the funds bought by Raiz Invest are PNB variable price funds which are all dominated in Ringgit and consists of Malaysian heavyweight stocks so risks are all contained in Malaysia and there will not be any forex related risks.

Looking at the returns of PNB's ASN variable price funds, you can see that equity funds have been underperforming for the past 1 year, if you put in funds 1 year ago, your returns would have been negative. The risks of moderate and safe funds are much lower at this era of Covid19.

If given a choice, PNB's fixed rate funds are a better option than Raiz Invest. PNB's fixed rate funds are much more safer than PNB's variable rate/price funds which Raiz Invest invests in.

I'm not using Raiz Invest's other features like the round up feature where it rounds up purchases and takes the rounded up amount and puts in the Raiz account. While I find it useful to do forced savings, prefer using ewallets (Boostpay, GrabPay, TouchNGo) to pay for my general purchases.

I use other robo advisors for different purpose.

Stashaway robo advisor I’m using it to practice Ray Dalio (legendary investor)’s principle of building an all weather portfolio that is global. I’m also using Mytheo for this purpose but I find this robo advisor over diversifies until it is hard to make and lose money. I just do the invest and forget method for these 2 robo advisors.

Wahed Invest robo advisor I’m using it for having a US MYR mixed portfolio that has some exposure to gold. I’m only topping up my Wahed Invest during times of crisis in the Malaysia and US stock markets. At the same time I’m quite glad the robo advisor’s exposure to gold helps cushion volitility.

Finally the latest newcomer to the market Akru, I’m just supporting it in very small amounts of money as it’s 100% homegrown in Malaysia. I’m just feeling a bit wanting to support a Malaysian built app. It’s yet to be proven but its component investments in Vanguard ETF makes it quite low risk and straightforward to understand.

I still do invest in local unit trust/mutual funds from Public Mutual, Manulife and Fundsupermart where I would pick very focus funds like country specific funds (eg India, Vietnam, Indonesia) or an industry focused fund (eg AI, Healthcare, REIT).

The conclusion is robo advisors are not get rich quick schemes, its performance will probably be on par or less with the existing unit trust/mutual funds out there but with lower cost of ownership (no sales charges, low management fees). The point of using robo advisors is to make investments faster and more automatic and aim to outperform existing low returns of fixed deposits.

🌟🌟🌟🌟🌟Referral (Limited Time Only) 👉 Referral code 4VZ2E3

Raiz Invest Malaysia is organizing a friend referral campaign. Each of us get RM5 after topping up just RM5 from your Maybank Account.

( 📍Update: This campaign has ended on 30/9/2020 and the reward of RM10 has been reduce to RM5 if you use my referral or any other Raiz Invest user's referral code)

🔗My Raiz Invest Sign Up Link 👉 :

I did a YouTube video as below explaining a bit of Raiz Invest and how it works :

🔗Links :

❓FAQ

Is Raiz Invest Portfolio Syariah Compliant ? Yes and No but is best to read the replies from Raiz Invest Team.

❓FAQ - All

📱Support Number

help@raiz.com.my

+603 2714 6114