Subscribing to Sukuk Prihatin Malaysia aka Malaysia Patriot Bonds ? 2% returns only. - closed already 2022

Just a couple of days ago, the current Malaysian government (Perikatan National) administration launched a RM 500 million fund raising initiative called Sukuk Prihatin under the National Economic Recovery Plan (Penjana). Sukuk Prihatin is basically a government Islamic bond where the money raised will be used to support the current economy which is at a decline due to the Covid19 situation. The Sukuk programme was launched by Prime Minister Tan Sri Muhyiddin Yassin in a ceremony witnessed by the Yang di-Pertuan Agong.

The funds raised by the government from Sukuk Prihatin will be channeled to Kumpulan Wang Covid-19 to fund measures announced in the government’s economic stimulus packages and recovery plan to address the Covid-19 crisis.

Sukuk Prihatin will have a payout of 2% (yes, just 2%) per annum for 2 years (profits tax exempted). The minimum amount to subscribe is RM 500. Application for the Sukuk Prihatin can only be done online via all the local bank's Internet Banking facility (eg Maybank, Ambank, Public Bank, BSN...) and hence the government is naming it the 1st digital sukuk in Malaysia. Purchases of the Sukuk Prihatin cannot be done by branch walk in.

WARNING : Do note there are 2 kinds of applications to the Sukuk Prihatin. Sukuk Prihatin Pelaburan and Sukuk Prihatin Sumbagan. Do not get it wrong, the Sukuk Prihatin Sumbagan is like a donation of your money to aid the government while the Sukuk Prihatin Pelaburan is the one that will give a payout of 2% and get back the principle amount upon maturity of the Sukuk.

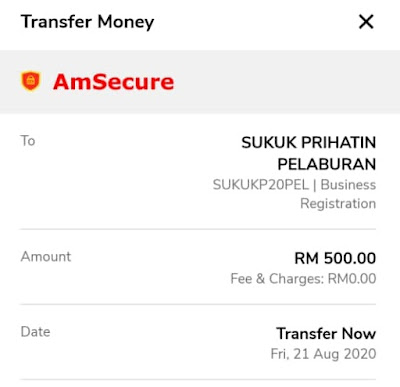

I opted to test out subscribing to the Sukuk Prihatin Pelaburan for just RM500. Most banking websites will have the similar procedures, and to subscribe you just need to transfer to a business registration entity using DuitNow with the following code SUKUKP20PEL (for Sukuk Prihatin Pelaburan). For Sukuk Prihatin Sumbagangan, the code is SUKUKP20SUM.

You need to enter your email address into the payment details and also put your mobile number in the recipient reference. The email address is for fund related notifications to be sent. For my case, I used Ambank internet banking Amsecure to subscribe to the Sukuk Prihatin.

https://www.hmetro.com.my/bisnes/2020/08/611777/sukuk-prihatin-boleh-dilanggan-bermula-rm500v

📜Ads

If you want to take on more risk with potentially higher returns than 2%. You can consider robo advisors like Stashaway, Wahed Invest, Mytheo and Raiz Invest. My referral codes and articles I wrote are as below :

Raiz Invest

https://propfessor.blogspot.com/2020/06/raiz-invest-fomerly-acorns-malaysia.html

🔗👉My Referral Link is as belows:

app.raiz.com.my/invite/4VZ2E3

Wahed Invest

https://propfessor.blogspot.com/2019/11/wahed-roboadvisor.html

🔗👉 Referral Invite Code : cheong1

Rakuten Trade

If you want more risks, you can go direct and invest in stocks, you can sign up for Rakuten trade using my referral code 4ffdWBHYBI. Alternatively you can use my referral link : https://www.rakutentrade.my/device/accountopening?referralcode=4ffdWBHYBI&mode=web