Stashaway Simple - money market fund with expected higher returns than fixed deposit ? Sign up with referral code : jonoav

Stashaway, the first robo advisor from Singapore that was launched in Malaysia has a new product called Stashaway Simple. Stashaway started in Singapore and it previously already launched the Stashaway Simple product in Singapore before introducing it to the Malaysian market.

Basically, Stashaway Simple is a money market fund that Stashaway introduced with a projected rate of return of 2.4%. This rate is considered quite high during this Covid19 situation now. The protected return is not only higher than other money market fund returns, it is on par with some of the fixed deposit rates given by banks. Historically, money market fund returns are always less than fixed deposit as money market are instrument banks use to borrow each other money in the case of 1 bank not having enough cash on hand.

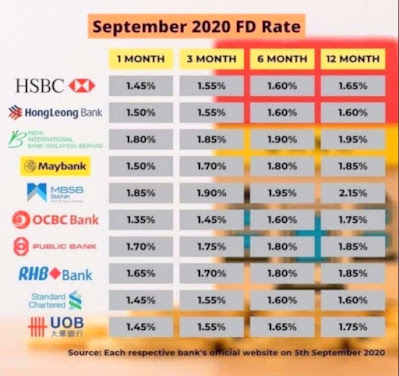

Here's the current fixed deposit rates in banks. The current rates are extremely low at sub 2.0% levels. I even previously signed up for Sukuk Prihatin Negara which I wrote a blog post here, government guaranteed bond at 2.0% also and it looks better than the current fixed deposit that banks offer. Having said that, I have to clearly state that fixed deposit and Stashaway Simple are not exactly similar products. The rates promised by Stashaway are not guaranteed, the 2.4% rate is merely a projected rate.

I have put in my maiden investment of RM450 into the Stashaway Simple money market fund to test its performance over time. I will update on the actual returns when I get returns from this fund.

🔗Links

https://www.stashaway.my/simple

https://www.stashaway.my/referrals/jonoav

https://www.theedgemarkets.com/article/investing-money-market-funds-through-fintech-startups

🔗Ads

If you are interested in signing up with Stashaway to get higher and FD (fixed deposit) returns, you can use my referral link or referral code jonoav to sign up and both of us will get 6 months of our management fees waived.

👉 My referral link : https://www.stashaway.my/referrals/jonoav